Compliance Made Clear. Client Management Made Simple.

Introducing iFindTaxPro

Built for Tax Professionals and their Clients to Master Tax and Local Compliance in One User-Friendly Platform.

iFindTaxPro simplifies compliance with AI-powered tools designed to save you time and stress.

Our Partners

Why Compliance Feels Overwhelming

Many businesses unknowingly leave gaps in compliance, leading to penalties, lost opportunities, and damaged trust.

- Small business owners lack resources for comprehensive oversight.

- Miscommunication with CPAs and EAs can cause tasks to fall through the cracks.

- Regulatory complexities demand tools that simplify and organize.

iFindTaxPro’s Proven Approach to Compliance Success

The DARC framework powers iFindTaxPro's approach to simplifying compliance:

- Discovery: Quickly gather essential compliance information through our guided Initial Interview.

- Assessment: Create a tailored Compliance Plan that identifies gaps and deadlines.

- Reminders: Never miss a critical task with proactive alerts and Calendar Integration.

- Compliance: Ensure every filing and obligation is met with precision and efficiency.

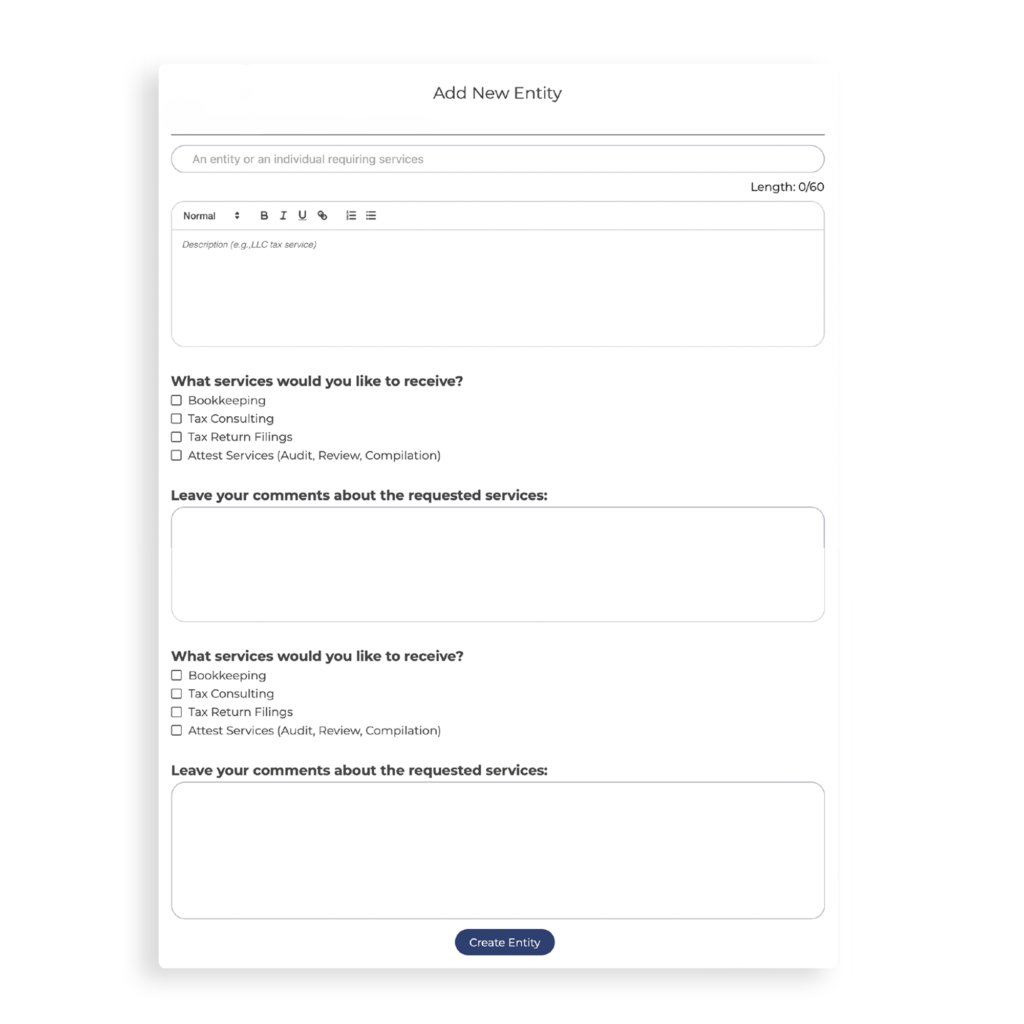

Streamline Your Client Onboarding Process

Eliminate the back-and-forth with clients by using our automated Onboarding Link. Simplify initial client contact, save time, and ensure every client is set up accurately from the start.

- Seamlessly onboard new clients.

- Facilitate client profile creation in iFindTaxPro.

- Ensure every client gets a seamless start to their compliance journey.

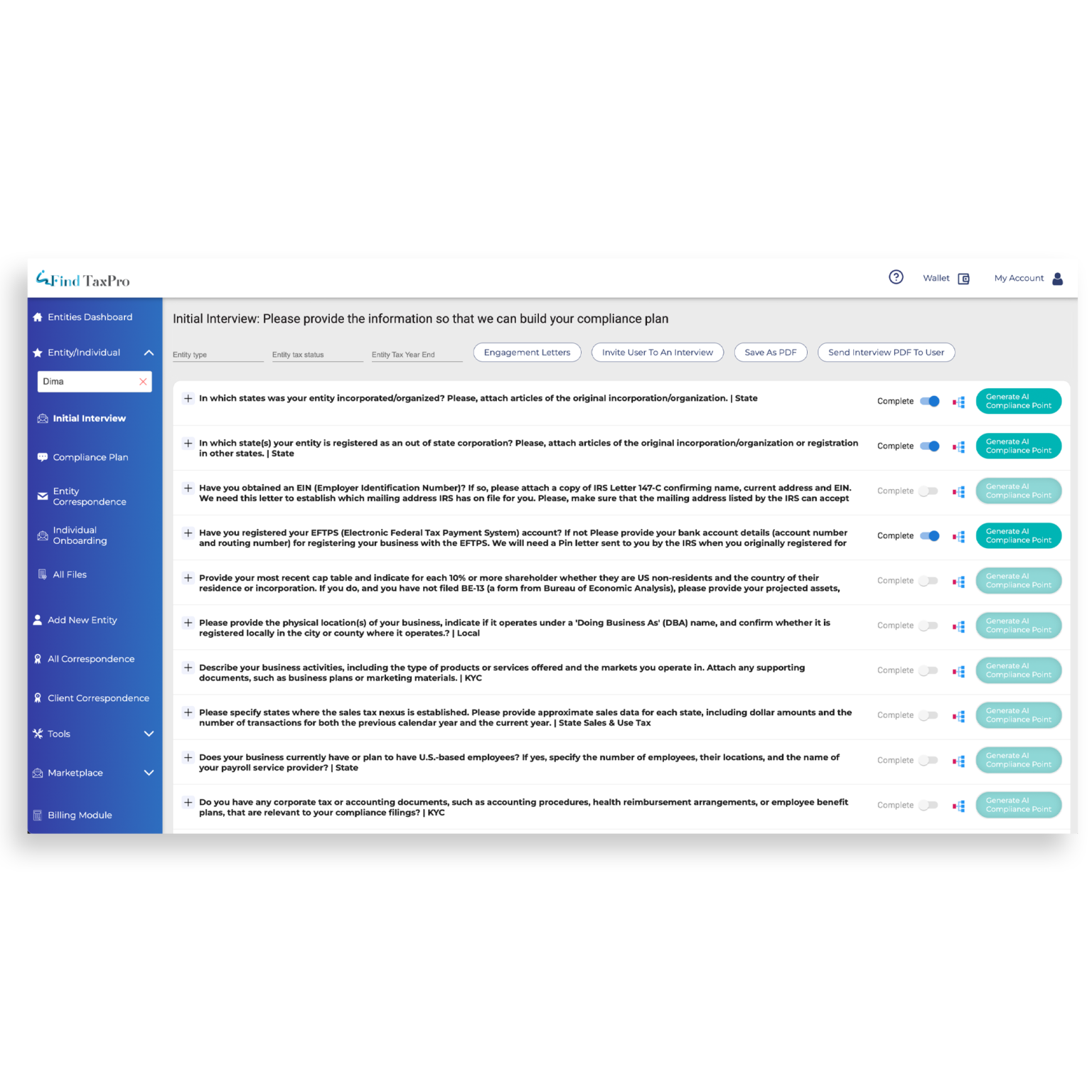

Tailored Compliance Begins Here

The Initial Interview sets the foundation for customized compliance planning. Gather all essential data with a guided questionnaire designed to identify key compliance needs.

- Save time with an intuitive, detailed tax compliance questionnaire.

- Lay the groundwork for a tailored Compliance Plan.

- Leverage our AI solution to generate custom compliance points.

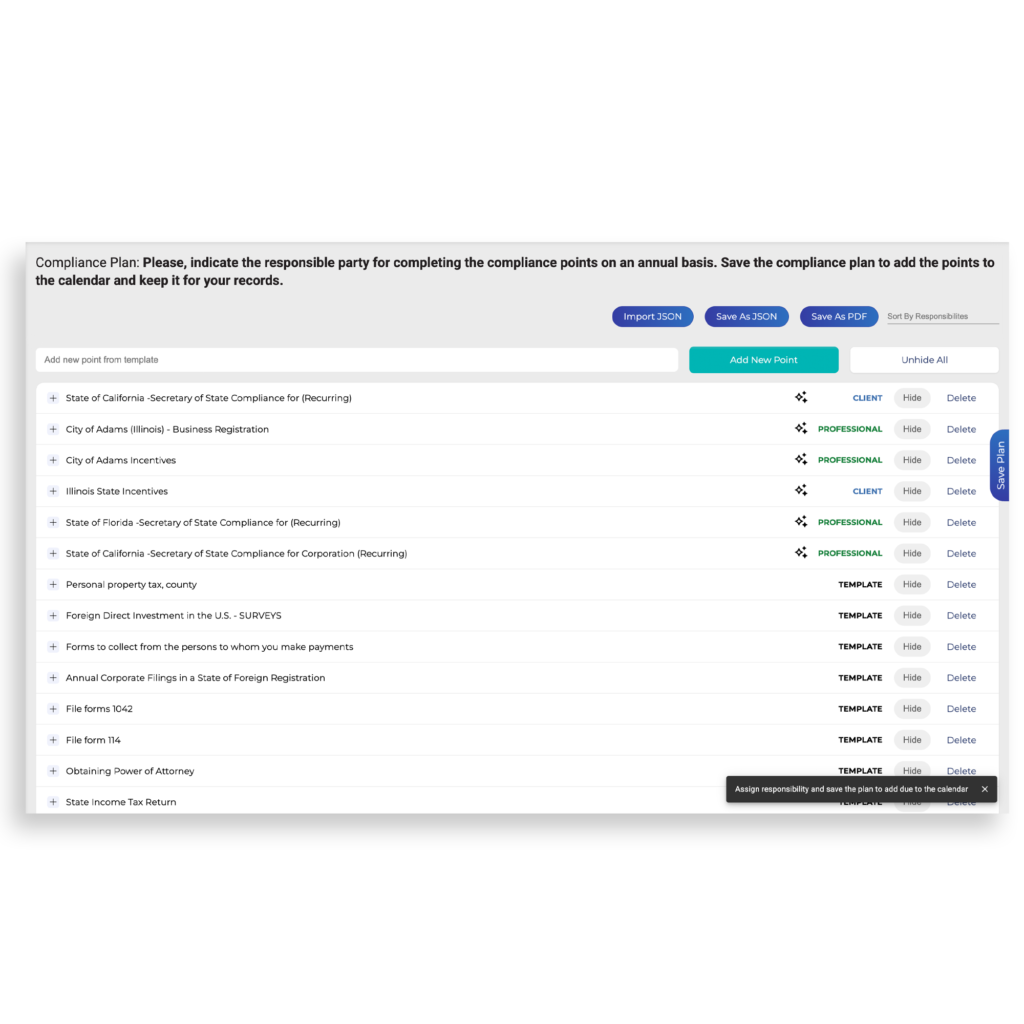

AI-Enhanced Compliance Plan

Your Customized Compliance Roadmap

Ensure every compliance task is covered with our dynamic AI-Enhanced Compliance Plan.

- Generate a customized checklist tailored to your client’s needs.

- Automate task prioritization to focus on what matters most.

- Achieve peace of mind with a compliance roadmap powered by AI insights.

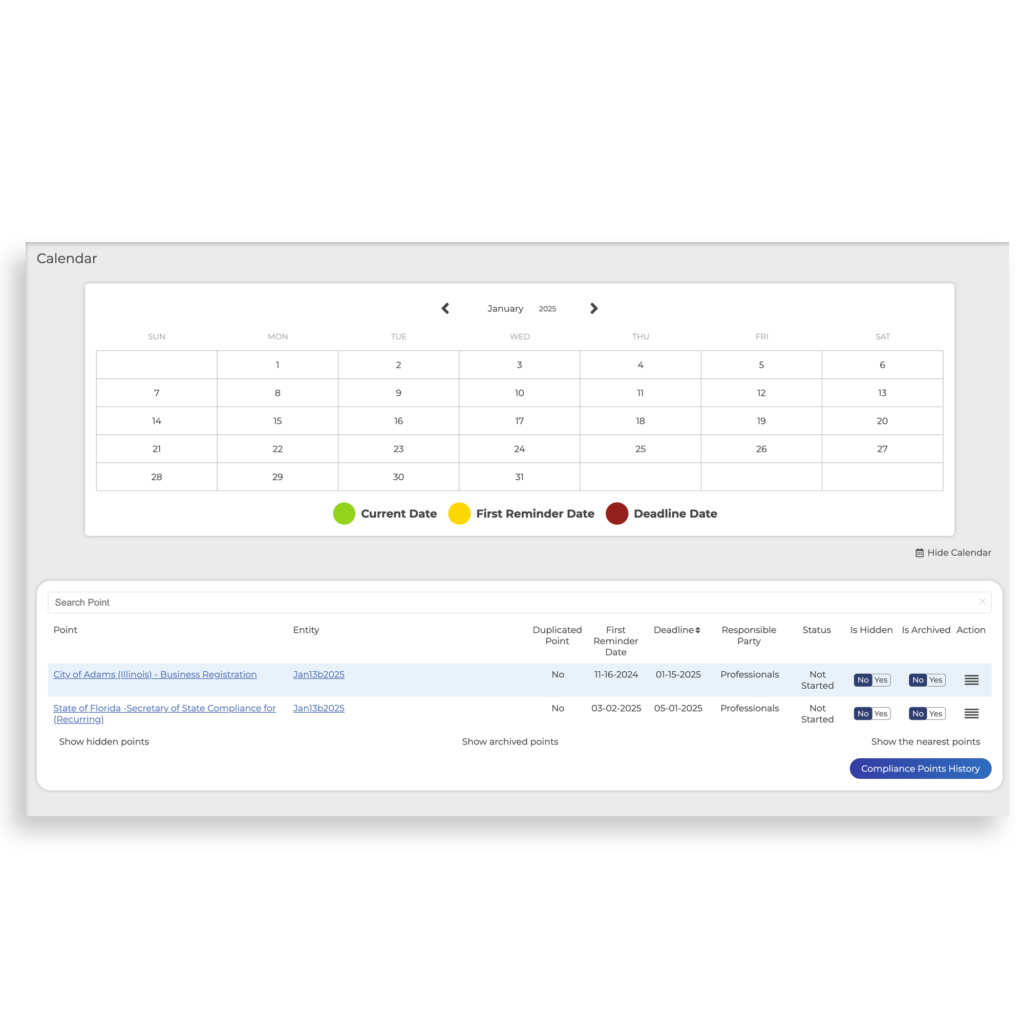

Never Miss a Deadline Again

Stay ahead with our integrated Calendar. Automatically track deadlines, schedule reminders, and manage compliance tasks effortlessly.

- Get proactive alerts for upcoming deadlines.

- Sync tasks seamlessly with your workflow.

- Maintain control with a clear, organized view of your schedule.

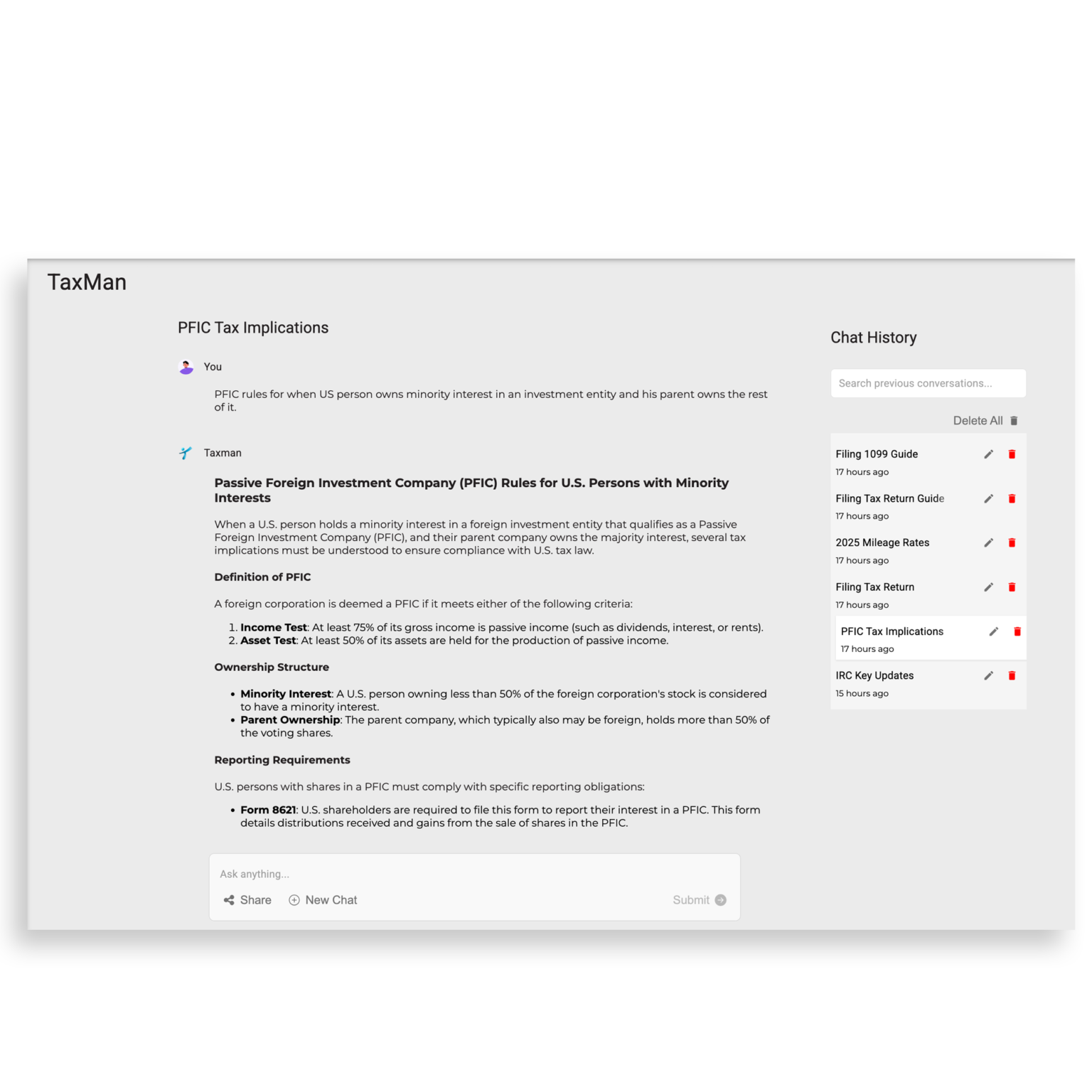

Taxman AI Assistant

Your Compliance Questions Answered Instantly

Taxman, your AI Assistant, is here to provide real-time answers to your tax questions. Simplify decision-making and save time with instant, reliable insights.

- Get answers to compliance queries instantly.

- Make informed decisions backed by AI-driven insights.

- Save hours on research and focus on what matters most.

Trusted by Professionals Nationwide

Plans for Every Professional

Whether you're a solo practitioner or managing a team, we have a plan for you.

Free Trial Subscription

- Up to 5 entities

- 50MB storage

- 100 in-system user-initiated messages per month

- 10 AI queries (Compliance Points + Taxman) per month

Basic Subscription

- Up to 15 entities

- 500MB storage

- 1,000 in-system user-initiated messages per month

- 100 AI queries (Compliance Points + Taxman) per month

Standard Subscription

- Up to 25 entities

- 2.5GB storage

- 3,000 in-system user-initiated messages per month

- 225 AI queries (Compliance Points + Taxman) per month

Premium Subscription

- Up to 75 entities

- 10GB storage

- 6,000 in-system user-initiated messages per month

- 500 AI queries (Compliance Points + Taxman) per month

Ready to Simplify Your Compliance Process?

Choose Your Plan and Start Today.

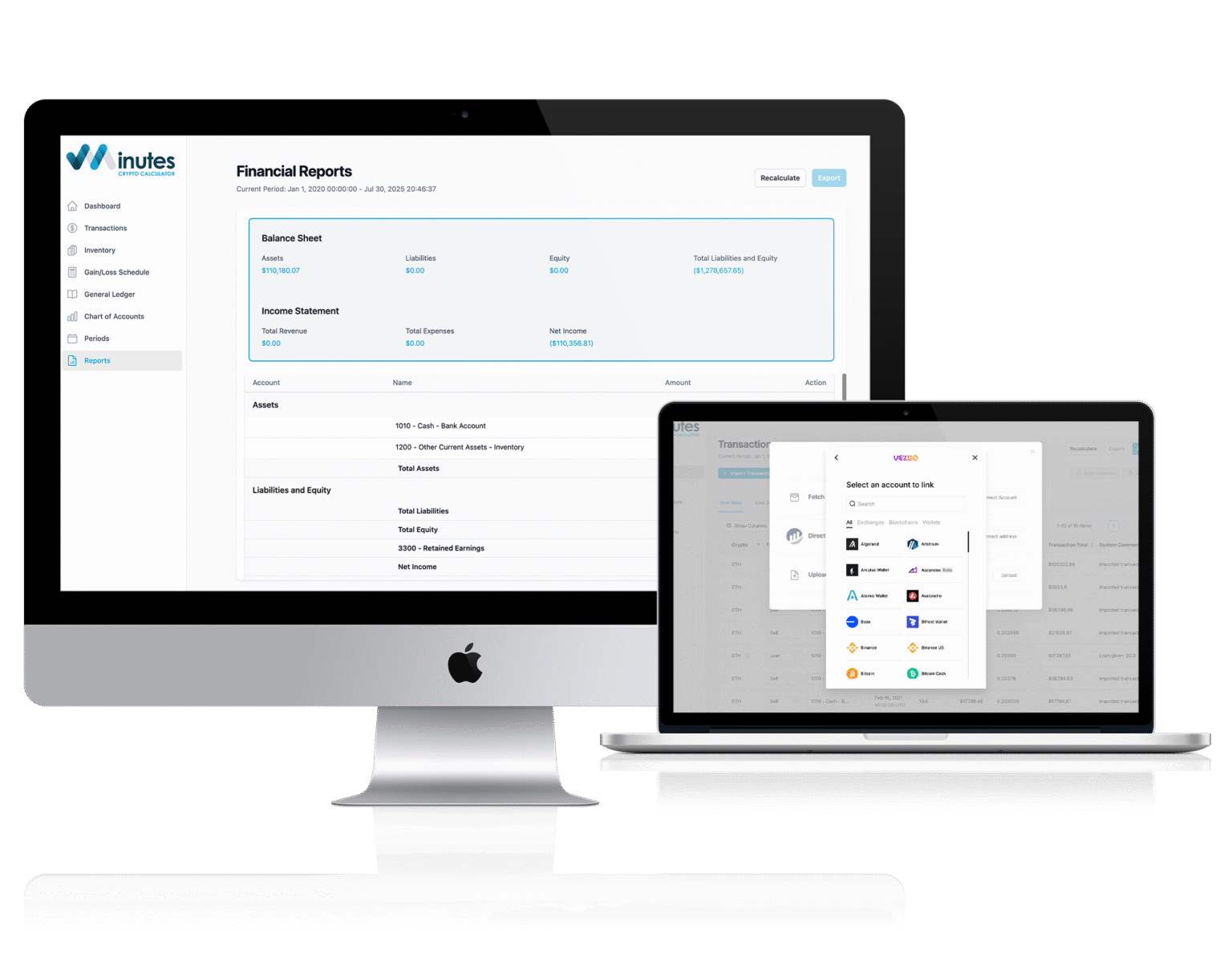

Introducing Minutes Crypto Calculator

A professional digital asset ledger and tax suite

- Integrations: Syncs with 580+ wallets and exchanges

- CSV-friendly: Import from any source

- Smart review: Flags duplicates, transfers, exchanges; auto-applies fees

- Coverage: DeFi, staking, cross-chain transfers

- Reports: Gains/losses, income, ledgers, reconciliation, CSV/PDF exports

- Controls: Notes, review status, change tracking for clean audits

- CPE-accredited ecosystem for tax professionals & business owners