If you run or finance a manufacturing business in the U.S., Section 70301 of the “One Big Beautiful Bill” is worth your full attention. It makes 100% bonus depreciation (full expensing) permanent for qualified business property under.

Popular News

See More

For years, companies could load up on debt and use the interest to shrink their taxes. Lawmakers wanted a clear, objective speed limit so the…

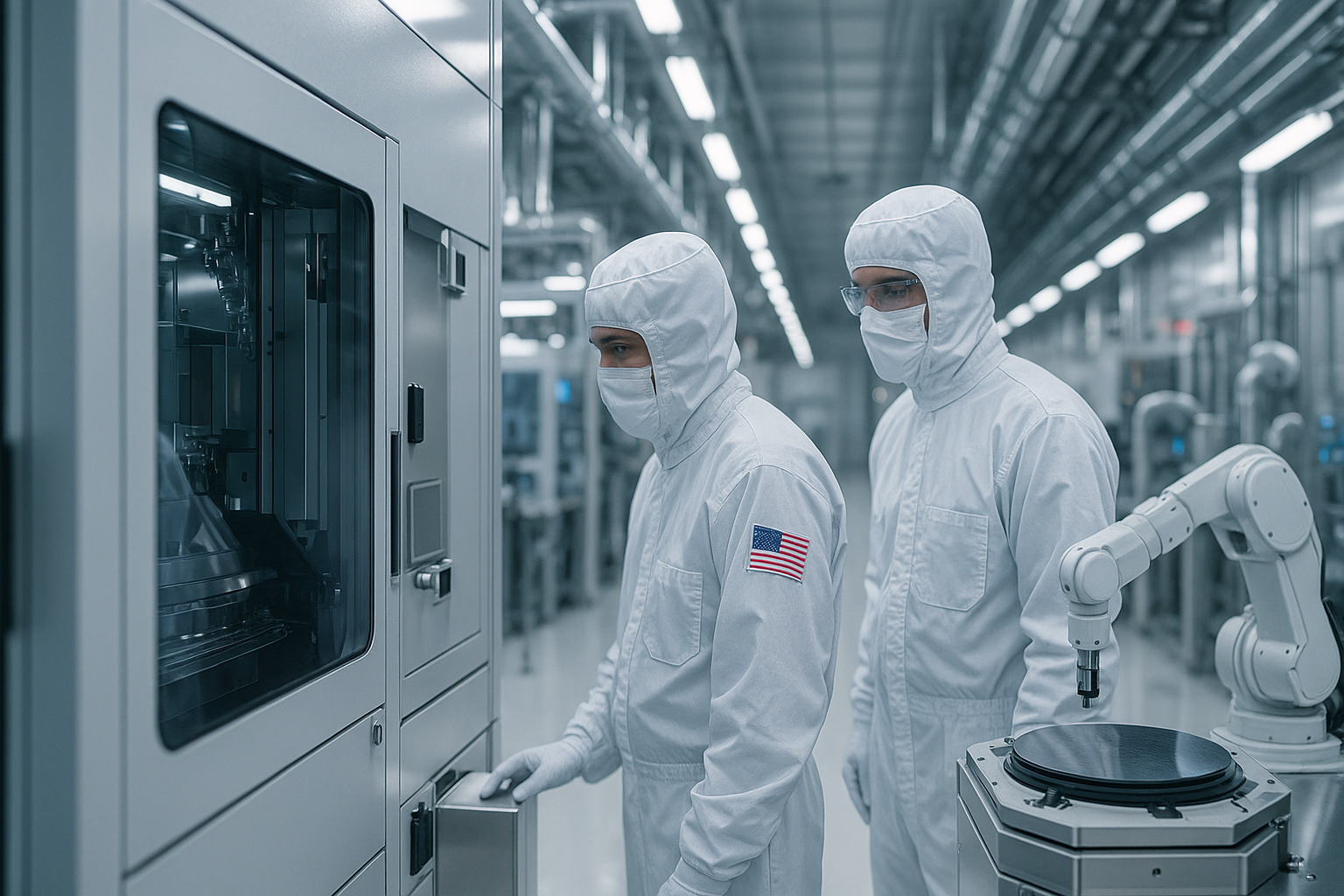

In July 2025, Congress raised the Advanced Manufacturing Investment Credit (AMIC) in the tax code’s §48D from 25% to 35%—for qualified property placed…

For decades, U.S. companies that invested in research and development (R&D) could immediately deduct those costs just like rent or wages. That…

The landscape of U.S. business taxation has shifted once again. With the passage of the **One Big Beautiful Bill—now formally the 2025 Act—**Congress…