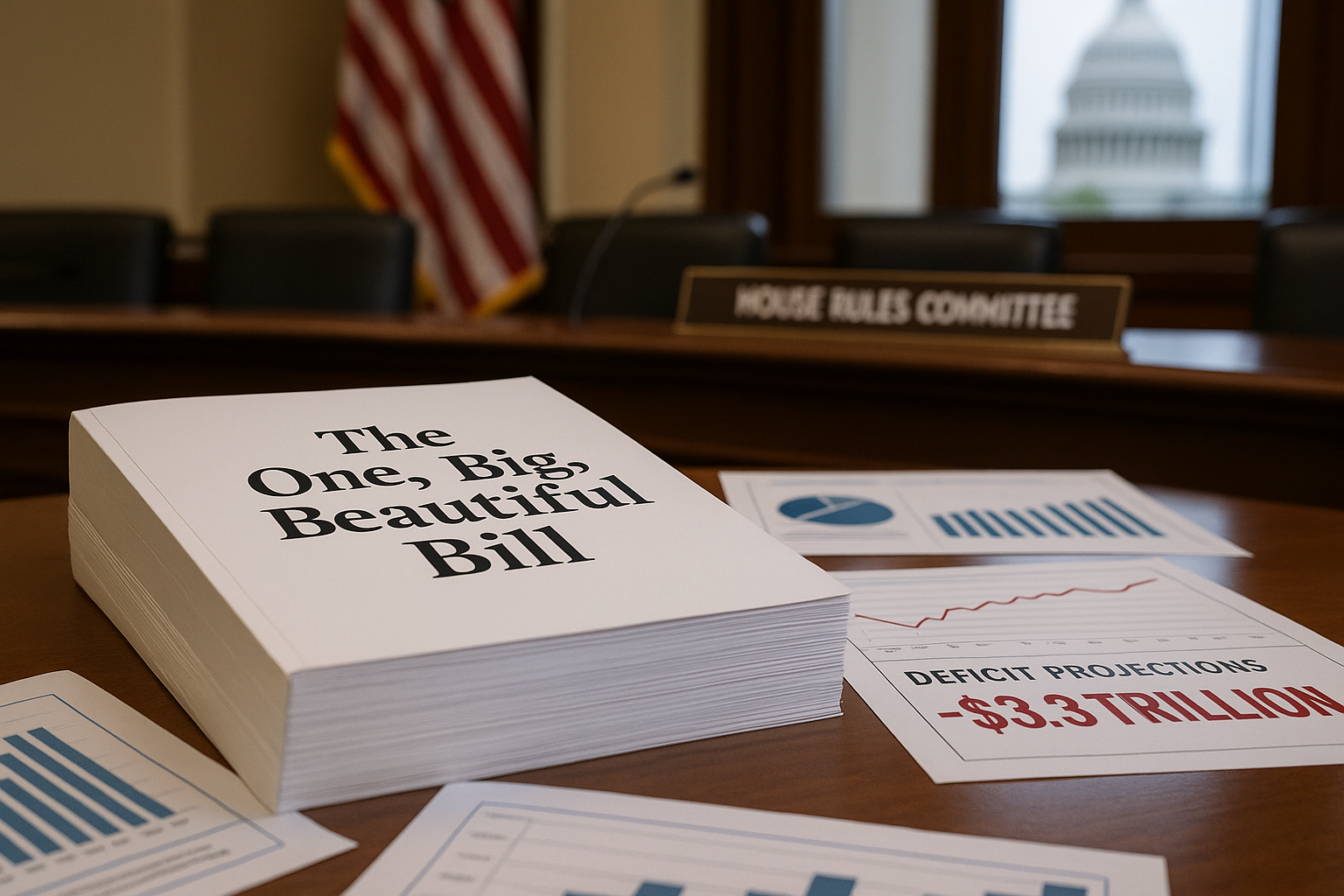

If you run or finance a manufacturing business in the U.S., Section 70301 of the “One Big Beautiful Bill” is worth your full attention. It makes 100% bonus depreciation (full expensing) permanent for qualified business property under.

Popular News

See More

📢 Interim Guidance Aims to Cut Compliance Costs Issued via IRS Notice 2025-27 on June 2, 2025 🏢 What is the CAMT? 💼 Corporate Alternative Minimum Tax…

A Strategic Look at the House’s “Big Beautiful Bill” and Its Impact on State Income Tax Rules 🗓️ As advanced to the U.S. Senate on May 22 | 🔍 Public…

⚖️ Case Summary: Tax Court Rules “Limited Partners” Were Actually Active Self Employment Tax Applies

📅 Case Date: May 28, 2025📍 Case: Soroban Capital Partners LP, TC Memo 2025-52🏛️ Court: U.S. Tax Court 🔍 Background at a Glance 🧾 Entity…

A Guide for Businesses, Workers, and Tax Professionals 🗓️ Passed by House Ways and Means Committee – May 14, 2025 The latest House tax reconciliation…