Recent Articles

Full Expensing Is (Back And) Permanent: Why This Is A Big Deal for U.S. Manufacturing

If you run or finance a manufacturing business in the U.S., Section 70301 of the “One Big Beautiful Bill” is worth your full attention. It makes 100% bonus depreciation (full expensing) permanent for qualified business property under IRC §168(k) and...

From Pilot to Permanent: The Evolution of the Federal Paid Family and Medical Leave Employer Credit

2017–2025: A temporary federal tax credit (the first try) 2025: Congress makes §45S stronger and permanent In July 2025, Congress enacted the One Big Beautiful Bill Act (Public Law 119-21). Section 70304 (“Extension and enhancement of paid family and medical...

Sourcing Inventory Income: Understanding Section 70313 and Its Impact on U.S. Manufacturers

Section 70313 of the recent tax legislation introduces new rules for sourcing income from the sale of inventory produced in the United States but sold abroad through foreign branches. While this may sound technical, it carries significant consequences for how...

Congress Finally Cleaned Up the International Tax Maze — And It Matters

For years, the U.S. international tax regime has been a patchwork of clever acronyms, cross-references, and allocation rules that too often produced ambiguous, burdensome, and sometimes unfair results. With Sections 70311–70323, Congress didn’t just tweak the system — it simplified...

The Interest-Deduction Speed Limit

For years, companies could load up on debt and use the interest to shrink their taxes. Lawmakers wanted a clear, objective speed limit so the deduction stays tied to real earnings not clever structuring. Today’s rules do exactly that. They...

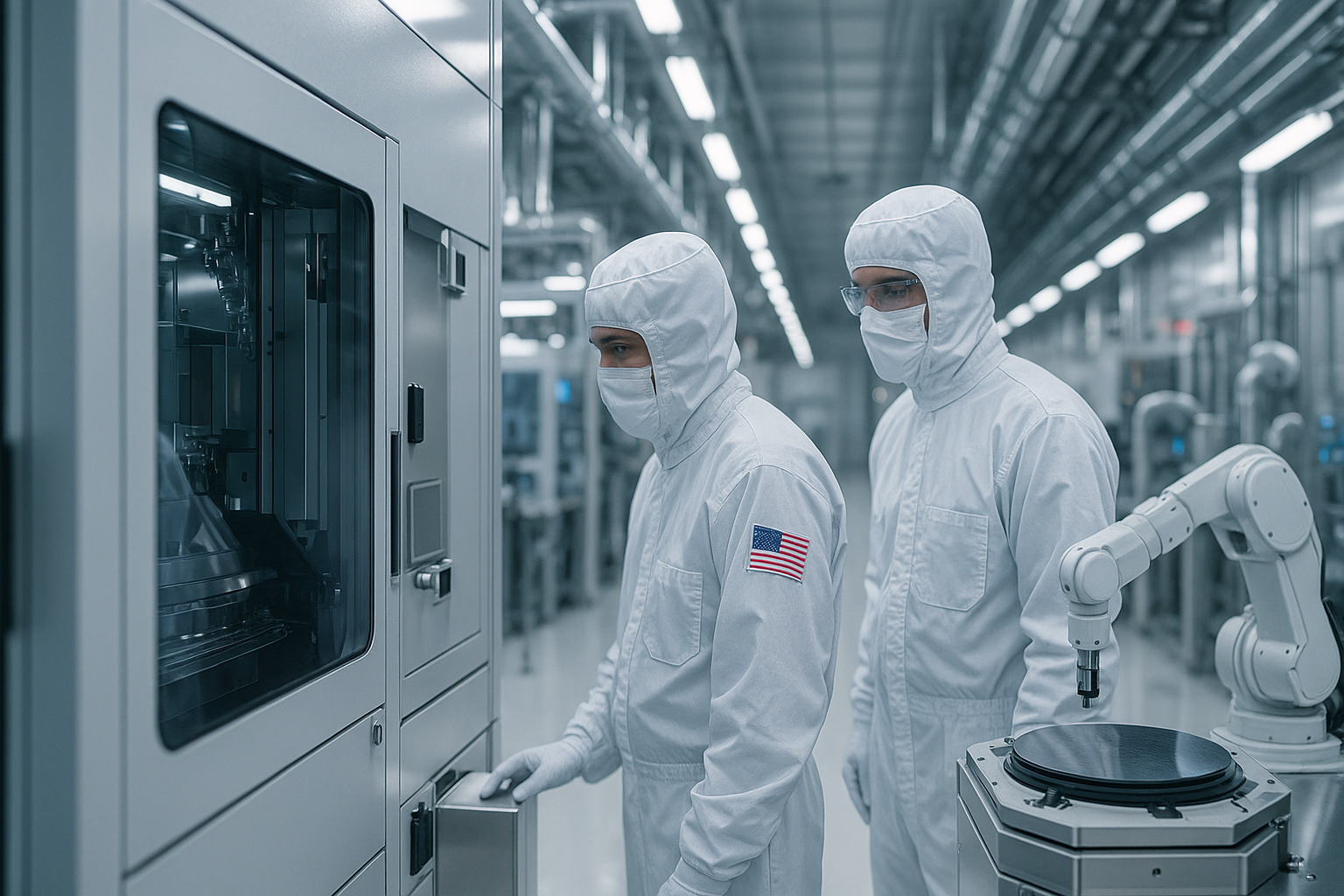

The Advanced Manufacturing Investment Credit: How We Got Here—and Why Congress’s 2025 Upgrade Is a Big Win for U.S. Chips

In July 2025, Congress raised the Advanced Manufacturing Investment Credit (AMIC) in the tax code’s §48D from 25% to 35%—for qualified property placed in service after December 31, 2025. This is a meaningful boost to America’s semiconductor build-out, tightening the...

Recent Posts

- Full Expensing Is (Back And) Permanent: Why This Is A Big Deal for U.S. Manufacturing

- From Pilot to Permanent: The Evolution of the Federal Paid Family and Medical Leave Employer Credit

- Sourcing Inventory Income: Understanding Section 70313 and Its Impact on U.S. Manufacturers

- Congress Finally Cleaned Up the International Tax Maze — And It Matters

- The Interest-Deduction Speed Limit

Recent Comments

Archives

- October 2025

- September 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- February 2022

- January 2022