Recent Articles

📘 America Brings Back Full Research Write Offs: What the New Law and IRS Rules Mean for Businesses

For decades, U.S. companies that invested in research and development (R&D) could immediately deduct those costs just like rent or wages. That policy, tucked into section 174 of the tax code, was designed to encourage innovation at home. But starting...

📘 The 2025 Act: What CFOs, Finance Leaders, and Tax Professionals Need to Know

The landscape of U.S. business taxation has shifted once again. With the passage of the **One Big Beautiful Bill—now formally the 2025 Act—**Congress has reset the rules for how American companies invest, innovate, and compete. For CFOs, finance directors, and...

📘 2025 Tax Act Executive Summary – Business & Public Insights

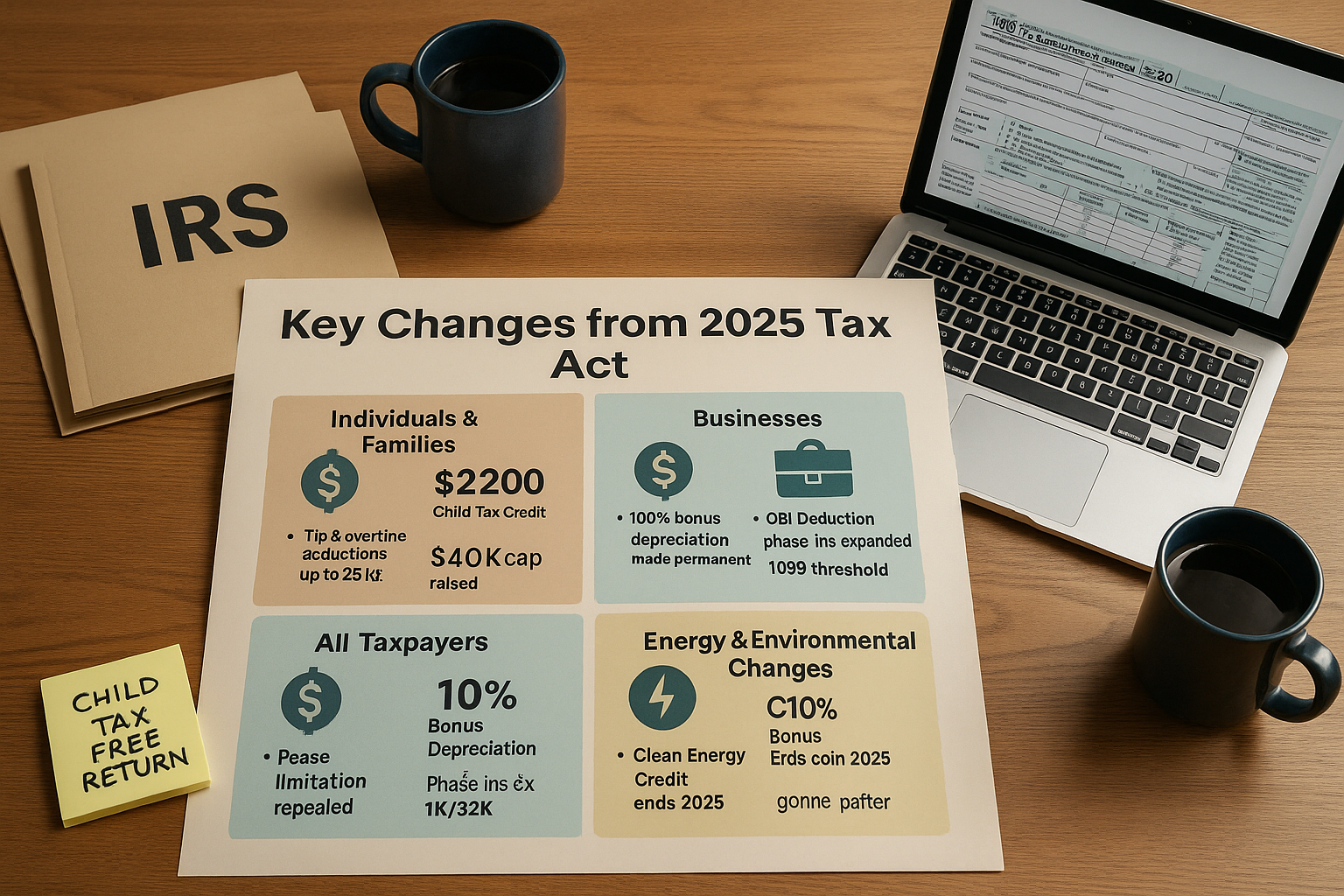

🏛️ The One Big Beautiful Bill (P.L. 119-21) permanently enacts many of the 2017 TCJA tax cuts, introduces new family- and business-friendly tax benefits, and refines several existing provisions. Below is a breakdown of the major changes: 💵 Permanent Reduction...

2025 IRS Tax Reform Highlights – Business & Public Edition

🧾 Prepared for: General Public & Business Community📅 Effective Period: Various provisions starting post-2025📚 Source: Internal Revenue Code (IRC), Amended by 2025 Tax Act 🚀 Expansion of Qualified Small Business Stock (QSBS) Gain Exclusion 📌 What’s New: 📈 New Limits:...

📘 2025 Tax Act Executive Summary – Business & Public Insights

🏛️ The One Big Beautiful Bill (P.L. 119-21) permanently enacts many of the 2017 TCJA tax cuts, introduces new family- and business-friendly tax benefits, and refines several existing provisions. Below is a breakdown of the major changes: 💵 Permanent Reduction...

💼💰 AbbVie Wins in Tax Court: $1.6B Breakup Fee Deemed Deductible Business Expense

🏛️ AbbVie Inc. v. Commissioner, 164 TC No. 10 (2025) 📖 Case in Brief In a major win for businesses navigating M&A deals, the Tax Court ruled in favor of AbbVie, holding that its $1.6 billion breakup fee paid to...

Recent Posts

- Full Expensing Is (Back And) Permanent: Why This Is A Big Deal for U.S. Manufacturing

- From Pilot to Permanent: The Evolution of the Federal Paid Family and Medical Leave Employer Credit

- Sourcing Inventory Income: Understanding Section 70313 and Its Impact on U.S. Manufacturers

- Congress Finally Cleaned Up the International Tax Maze — And It Matters

- The Interest-Deduction Speed Limit

Recent Comments

Archives

- October 2025

- September 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- February 2022

- January 2022