Recent Articles

Tax Strategies for Film and TV Animation Studios

Maximizing Tax Efficiency in the Animation Industry: Production Costs and Animation Software Expenses The film and television animation industries make large investments in production costs and animation tools. Understanding and implementing appropriate tax methods can save animation companies a lot...

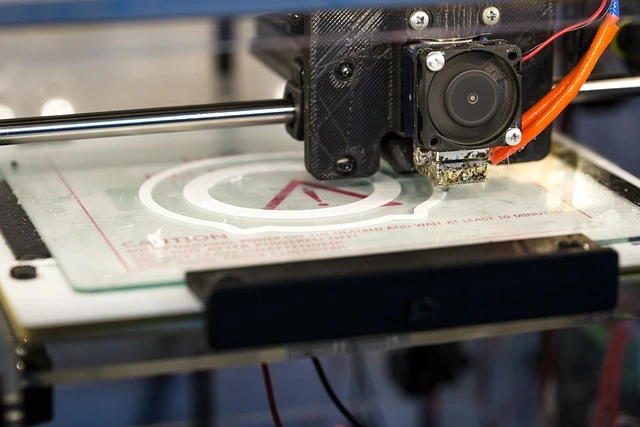

Tax Strategies for 3D Printing Services

Maximizing Tax Efficiency in the Growing 3D Printing Industry: Printing Equipment Depreciation and Material Costs The 3D printing industry is quickly expanding, providing novel solutions in a variety of sectors. As a 3D printing service provider, it is critical to...

Impact of Supreme Court Cases on Sales Tax Nexus

Understanding How Key Legal Decisions Shape Sales Tax Nexus and Compliance Requirements: A Focus on South Dakota v. Wayfair The landscape of sales tax nexus and compliance has been drastically altered by historic Supreme Court decisions, most notably South Dakota...

Tax Considerations for Cosmetic Surgeons

Maximizing Deductions and Ensuring Compliance in Your Cosmetic Surgery Practice: Medical Equipment and Practice Expenses Running a cosmetic surgery clinic entails dealing with a slew of tax issues, from deducting the cost of medical equipment to managing overall practice expenses....

Taxes on Cryptocurrency Trading: Insights from Tax Professionals

Navigating the Complexities of Crypto Taxes with Expert Guidance Cryptocurrency trading has grown in popularity, bringing a slew of tax issues. The decentralized structure of cryptocurrency complicates tax reporting and compliance. Understanding the tax implications of cryptocurrency trading is critical...

Tax Considerations for Wildlife Conservation Organizations

Navigating Tax Benefits and Compliance for Effective Conservation Work: Nonprofit Tax Status and Conservation Efforts Wildlife conservation organizations are important in biodiversity protection and natural habitat preservation. Operating as a nonprofit organization provides major tax benefits, but it also necessitates...

Recent Posts

- Full Expensing Is (Back And) Permanent: Why This Is A Big Deal for U.S. Manufacturing

- From Pilot to Permanent: The Evolution of the Federal Paid Family and Medical Leave Employer Credit

- Sourcing Inventory Income: Understanding Section 70313 and Its Impact on U.S. Manufacturers

- Congress Finally Cleaned Up the International Tax Maze — And It Matters

- The Interest-Deduction Speed Limit

Recent Comments

Archives

- October 2025

- September 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- February 2022

- January 2022