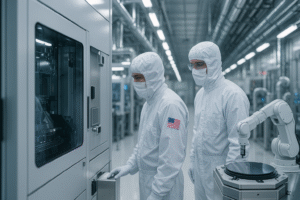

Full Expensing Is (Back And) Permanent: Why This Is A Big Deal for U.S. Manufacturing

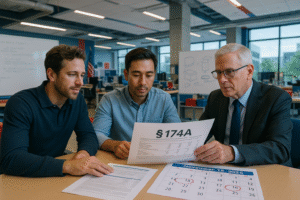

If you run or finance a manufacturing business in the U.S., Section 70301 of the “One Big Beautiful Bill” is worth your full attention. It makes 100% bonus depreciation (full expensing) permanent for qualified business property under IRC §168(k) and