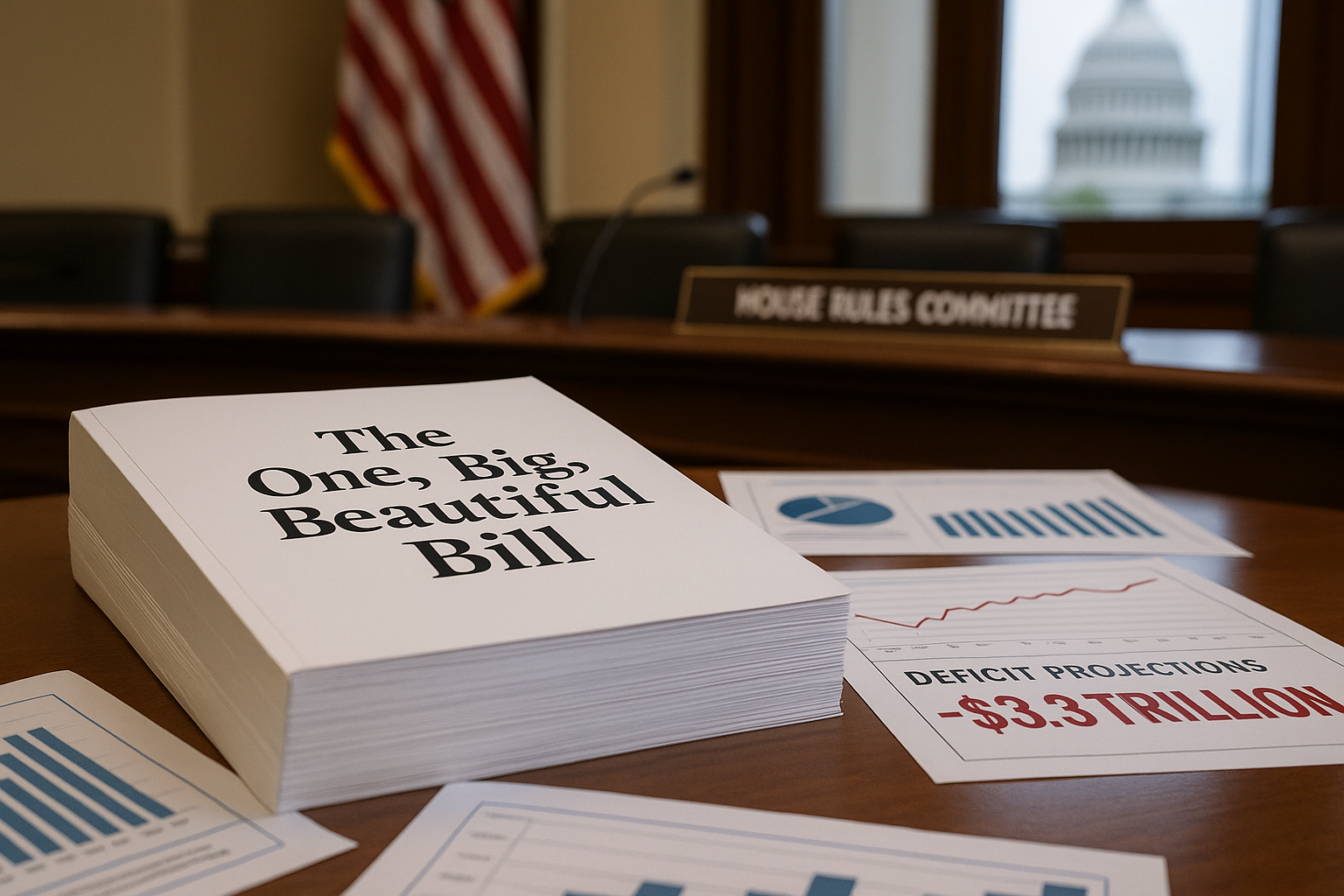

A Guide for Businesses, Workers, and Tax Professionals

🗓️ Passed by House Ways and Means Committee – May 14, 2025

The latest House tax reconciliation bill introduces a wide range of reforms impacting payroll, employee benefits, and tax planning. From tip and overtime deductions to expanded family leave credits and tighter oversight on tax credits, here’s a breakdown of what you need to know — with helpful icons and simplified explanations.

💰 Permanent Tax Cuts for Individuals

- ✅ Lower Income Tax Rates Locked In:

Preserves the reduced federal tax brackets from the 2017 Tax Cuts and Jobs Act (TCJA), including the top rate cut from 39.6% to 37%. - 🏠 Standard Deduction Made Permanent:

- Married Filing Jointly: $32,600 (starting 2026)

- ✖️ Personal exemptions permanently repealed.

📦 Eliminations & Repeals

- 🚚 Moving Expense Deductions Eliminated (Except Military): No more exclusions or deductions for relocation expenses unless you’re active-duty military.

- 🚴♂️ Bicycle Commuting Tax Benefit Repealed: The $20/month exclusion for bike commuters is gone for good after 2025.

💵 New Payroll-Related Deductions

- 💁♀️ No Tax on Tips (2025–2028):

Employees and eligible contractors can deduct qualified tips from taxable income.

✅ Must be:- Voluntarily given by customer

- Not negotiated in advance ❌ Not available for high-income earners or certain service businesses.

- 🕐 No Tax on Overtime Pay (2025–2028):

Overtime wages paid above standard hours under FLSA can be deducted.

✅ Conditions:- Must meet overtime pay rules

- Not available to highly compensated employees

👶 Enhanced Employer Credits & Benefits

- 🧒 Child Care Tax Credit for Employers:

- 🔼 Credit cap raised to $500,000 (from $150,000)

- 💼 Small businesses: up to $600,000 credit

- 📊 Covers 40–50% of qualifying expenses

- 💡 New pooling options and third-party arrangements allowed

- 👪 Paid Family & Medical Leave Credit

- 🔁 Made permanent

- 💸 Covers 12.5%–25% of wages during leave

- 🏛️ Includes insurance premiums

- ⏱️ Reduced eligibility period for employees (6 months instead of 1 year)

- 👶 Adoption Credit Boosted:

- 📥 Up to $5,000 made refundable

- 🔁 Nonrefundable portion still carried forward

- 🎯 Helps lower-income families with limited tax liability

- 🎓 Employer Student Loan Assistance Exclusion:

- 🔒 Permanently allows employers to provide up to $5,250 in student loan payments tax-free

- 📈 Indexed for inflation

🏥 Health Plan Modernization

- 🏥 CHOICE Arrangements (formerly ICHRAs):

- 💼 Employers can reimburse employees for buying personal health insurance

- 🔐 Officially codified in law

- 🧾 Eligible for tax-preferred treatment

- 🧾 Expanded CHOICE Plan Incentives for Small Employers:

- 💰 Tax credit:

- $100/month per employee (Year 1)

- $50/month per employee (Year 2)

- 💰 Tax credit:

- ✅ Available for businesses with fewer than 50 employees offering CHOICE plans for the first time

🧾 EITC Reforms for Accuracy & Integrity

- 🔍 Stronger Oversight on Earned Income Tax Credit (EITC):

- 📬 IRS will notify taxpayers of duplicate child SSN use

- 🕒 Refund delays until October 15, 2025 for claims under review

- ⚖️ New pre-certification process for better accuracy

- 🎖️ Special credit added for Purple Heart recipients returning to work

🛑 Crackdown on Fraudulent ERC Claims

- 💼 Stricter Enforcement of Employee Retention Credit (ERC):

- 💣 $1,000 penalty for ERC promoters who fail due diligence

- ❌ IRS barred from paying claims filed after January 31, 2024

- ⚖️ More power for IRS to pursue abusive credit schemes

📈 Summary: What This Means for Employers & Workers

✅ Business Owners:

- Expanded credits reduce your tax bill and support benefits like child care and leave

- New flexibility in offering health coverage

- Deductible overtime and tip pay can boost employee retention

✅ Employees & Gig Workers:

- Direct tax savings on tips and overtime (if qualified)

- Better access to family leave and adoption support

- More help repaying student loans