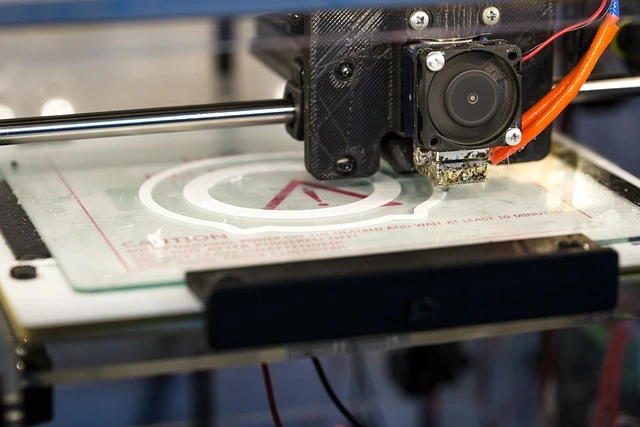

Maximizing Tax Efficiency in the Growing 3D Printing Industry: Printing Equipment Depreciation and Material Costs

The 3D printing industry is quickly expanding, providing novel solutions in a variety of sectors. As a 3D printing service provider, it is critical to understand how to maximize your tax approach, particularly in terms of equipment depreciation and material expenses. This guide will go over essential tax concerns and solutions for increasing your business’s tax efficiency.

Understanding Equipment Depreciation for 3D Printing Services

What is depreciation?

Definition: Businesses can spread out the expense of tangible assets throughout their useful lives by using depreciation.

Importance: It gives a tax deduction that can reduce taxable income, lessening the overall tax burden.

Depreciation methods:

Straight Line Depreciation: Distributes costs evenly over the asset’s useful life.

Declining Balance Depreciation: Increases deductions by permitting bigger deductions in the asset’s early years of life.

Section 179 Deduction: Subject to certain limits, businesses can deduct the full purchase price of qualified equipment in the year it is purchased.

Depreciation for 3D Printing Equipment:

Capitalization: Determine whether to capitalize and depreciate equipment or to expense smaller goods right away.

Useful Life: The IRS normally classifies machinery and equipment, including 3D printers, as having a 5 to 7-year useful life for depreciation purposes.

Material Costs and Tax Deductions

Deductible Material Costs:

Material types: Include filaments, resins, powders, and other printing consumables.

Direct Costs: Expenses that are directly related to the printing of goods are deductible.

Inventory Control:

Accounting Approaches: To manage inventory costs, you can use either cash or accrual accounting.

Cost of Goods Sold (COGS): Calculating COGS accurately can have an impact on overall taxable revenue.

Special considerations:

R & D Credits: Materials used in research and development may qualify for R&D tax credits.

Bulk purchases: Track and allocate expenditures precisely, especially when purchasing supplies in bulk.

Additional tax strategies for 3D printing businesses.

Research and Development (R&D) Tax Credits:

Eligibility: Costs linked with the development of new products, processes, or enhancements may qualify.

Documentation: Keep detailed records of R&D activity and expenses to support credit claims.

Business Expense Deduction:

Operational costs: Deduct expenses like utilities, rent, salaries, and marketing.

Professional Fees: The costs of legal and accounting services are deductible.

Tax Planning and Professional Advice.

Regular reviews: Hold regular tax planning workshops to stay current on tax law changes and optimize tax positions.

Professional Assistance: Consult with tax experts who understand the complexities of the 3D printing sector.

Compliance and Record-Keeping

Accurate Record-keeping:

Expense Documentation: Maintain detailed records of all business expenses, such as receipts, invoices, and payment records.

Depreciation schedules: Keep accurate depreciation schedules for all equipment.

Compliance with Tax Laws:

IRS regulations: Stay current on IRS regulations and guidelines that apply to your industry.

State and Local Taxes: Be aware that state and local tax requirements can vary greatly.

Understanding and exploiting equipment depreciation and material cost deductions is critical for optimizing tax strategies for 3D printing services. By remaining informed and employing the proper tax methods, you can decrease your tax bill while investing more in the growth and innovation of your company. Engaging with tax professionals can help assure compliance and optimize the benefits of your 3D printing service. Also, consider utilizing marketplaces like IfindTaxPro, you can post your project and find the right professional for your needs.