Recent Articles

Taxation for Data Analytics and Business Intelligence Companies

Maximizing Tax Efficiency for Data-Driven Businesses: Software Development Costs and Data Management Deductions Innovation has become one of the main driving factors in the world of data analytics and Business Intelligence (BI). But when tax time comes, the focus shifts...

Tax Planning for Interior Designers and Decorators

Maximizing Deductions and Optimizing Financial Management in the Design Industry: Design Software Expenses and Design Consultation Fees Interior design is a profession that focuses on creating attractive and functional spaces. And yet tax season can be quite unappealing to interior...

Customizable Calendars for Tax Professionals

Optimizing Time Management and Enhancing Efficiency in Tax Preparation: Tailoring Schedules to Your Needs Tax accountants deal with many tasks. With an average day ranging from client appointments to deadline management and software updates- being organized is essential. With this...

Tax Planning for Non-Emergency Medical Transportation (NEMT) Services

Maximizing Deductions and Minimizing Liability: Essential Strategies for Managing Tax Obligations in the NEMT Industry The NEMT industry does what is possibly most important, transporting people to medical facilities and hospitals. However, tax season brings a complex path for NEMT...

Navigating Payroll Tax Compliance

Essential Tips for Ensuring Accuracy and Compliance in Payroll Tax Management: Avoiding Common Pitfalls and Finding Solutions Payroll processing is not only about the calculation of salaries and wages but also about the other many tasks that are involved in...

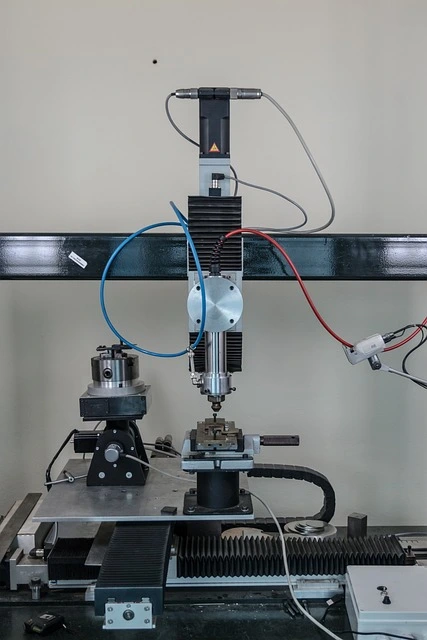

Tax Implications for Manufacturing Automation Companies

Maximizing Deductions and Managing Depreciation in the Automation Industry The rise of automation is changing manufacturing, and automation companies need to navigate the tax environment. This guide explores key tax considerations and helps you optimize your tax planning by focusing...

Recent Posts

- Full Expensing Is (Back And) Permanent: Why This Is A Big Deal for U.S. Manufacturing

- From Pilot to Permanent: The Evolution of the Federal Paid Family and Medical Leave Employer Credit

- Sourcing Inventory Income: Understanding Section 70313 and Its Impact on U.S. Manufacturers

- Congress Finally Cleaned Up the International Tax Maze — And It Matters

- The Interest-Deduction Speed Limit

Recent Comments

Archives

- October 2025

- September 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- February 2022

- January 2022