Recent Articles

Optimizing Cash Flow with Corporate Credit Cards

Leveraging Corporate Credit Cards for Financial Efficiency and Control: Benefits and Best Practices Getting a good cash flow is crucial in business in the constantly changing world. Corporate credit cards are a great financial tool for companies when they are...

Tax Strategies for Sports Training Facilities

Leveraging Tax Benefits to Optimize Financial Performance in Training Facilities: Maximizing Deductions and Credits Regarding sports training, which has grown into a competitive domain, facilities are considered one of the key elements that help athletes reach exceptional performance. Sports training...

Tax Court Upholds Extension of Statute of Limitations in Murrin v. Comm.

Court Ruling in Murrin v. Comm. Highlights Impact of Tax Preparer Fraud on Statute of Limitations In the case of Murrin v. Comm., TCM 2024-10, an audit was conducted on tax returns filed nearly two decades earlier, where fraudulent entries...

Diversifying Your Investment Portfolio

Strategies for Risk Management: Mitigating Risk Through Diversification Techniques The investment world is by nature a dynamic environment, where asset prices vary daily. Diversification, which is a measure of placing your money in different asset classes, is achieved by spreading...

Tax Implications for Commercial Fishing and Seafood Businesses

Navigating Commercial Fishing Income and Fisheries Conservation Deductions Commercial fishing is a vital part of the global food supply chain. Nevertheless, the financial aspects of this industry, especially concerning tax issues, are difficult to handle. This guide examines essential tax...

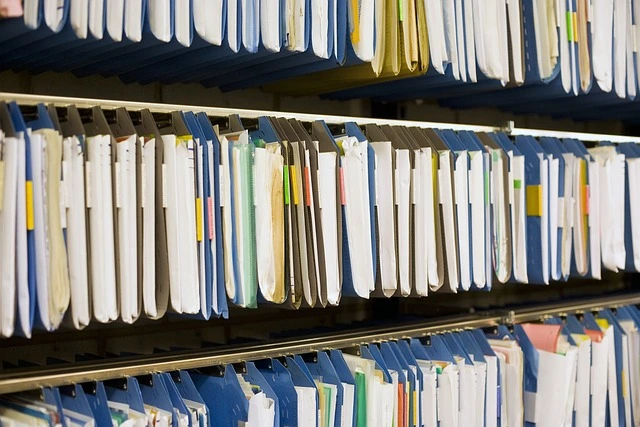

Maximizing Tax Deductions through Proper Document Management

Streamlining Tax Compliance with Effective Document Organization Come tax season, hunting for lost receipts and invoices can be quite stressful. However, what would happen if you came across a system that would allow you to meticulously document all your expenses...

Recent Posts

- Full Expensing Is (Back And) Permanent: Why This Is A Big Deal for U.S. Manufacturing

- From Pilot to Permanent: The Evolution of the Federal Paid Family and Medical Leave Employer Credit

- Sourcing Inventory Income: Understanding Section 70313 and Its Impact on U.S. Manufacturers

- Congress Finally Cleaned Up the International Tax Maze — And It Matters

- The Interest-Deduction Speed Limit

Recent Comments

Archives

- October 2025

- September 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- February 2022

- January 2022