Streamlining Tax Compliance with Effective Document Organization

Come tax season, hunting for lost receipts and invoices can be quite stressful. However, what would happen if you came across a system that would allow you to meticulously document all your expenses and make them tax-deductible? This is where the role of effective document management is important. By developing a direct approach for getting, arranging, and storing your business files, you will for sure make tax filing much easier and use more options for your deductions as well.

The Benefits of Organized Documentation:

Effortless Retrieval

Forget about the agony of misplaced receipts! With a well-organized system, you can be able to find any document that you need within your record in seconds thereby saving you time and frustrations during tax preparations.

Substantiated Deductions

The IRS may need evidence to validate or disallow any deduction. Having an organized record helps you get all relevant receipts to back up your deductions, as well as stay away from the risk of a possible tax audit.

Peace of Mind

Knowing your files are secure and easy to access eliminates incessant anxiety and helps you to dedicate all your attention to doing business.

Building a Document Management System:

Choose Your Method

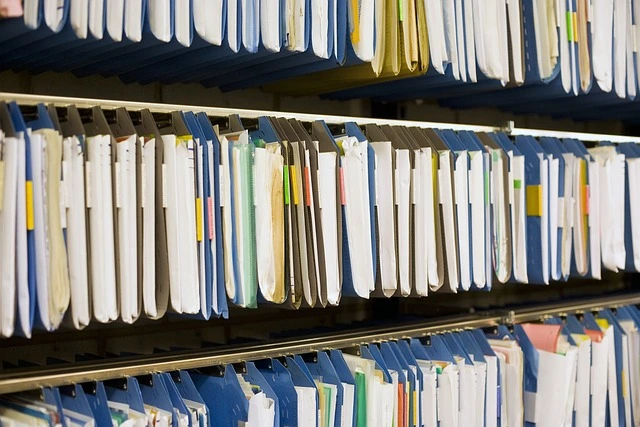

For a document management approach, one can consider various approaches. Filing cabinets may work for some, while others can be okay with cloud storage or dedicated document management software. The principle is to settle on a system that can work for you and best suits your workflow and individual preferences.

Categorize and Label

Set up a uniform and uncomplicated mechanism for classifying your documents. This could be done by breaking them down by the category of expenditure (e.g., supplies for office, marketing, travel), project, or vendor. Make sure your labels are readable and have an easy search.

Standardize Naming Conventions

Adhere to a uniform standard for naming your documents. It could be as straightforward as giving the date, the vendor name, and an expense outline. Consistent data tagging helps to look up and retrieve a document even in confusing situations much easier.

Automate Where Possible

It would be worth looking into automatic download and categorization of transactions on online banking or credit card platforms if you have been using these for business. This will help in cutting your time and work (by not manually inputting your receipts)

Maintaining Your System:

Regular Upkeep

Set up a consistent schedule (based on your preference every week or month) for going through your paperwork. It’s better not to let them pile up as they can then become too hard to deal with.

Declutter and Shred

Evaluate your stored documents periodically and securely destroy outdated ones as well as any unnecessary paperwork to build a clean system of private documents. Besides, apply data security best practices when disposing of electronic documents too.

Backup Regularly

If you work with digital document management systems, have a backup plan established for unexpected malfunction or cyber attacks to have your data secured.

Additional Tips:

- Embrace Receipt Scanning Apps: Lots of apps for smartphones are available to scan and store paper receipts electronically. This makes those transactions easier to locate and put into the right category right away.

- Utilize Accounting Software: The accounting software helps to keep track of the expenses and document management in an automated manner. Nowadays, several programs allow you to attach a copy of your receipt to a digital transaction, which is what allows you to simplify record-keeping.

- Educate Your Employees: When running an organization where employees generate a lot of business expenses, ensure that you teach them the document management system and the correct way of keeping receipts and documents.

A well-designed file management system ensures that you can gather necessary papers and minimize paper collection at the time of tax filing. Therefore, you can easily and quickly get the claimed deductions and reduce possible tax issues. This is where simple planning and organizing can come in handy. Thus, it is now easy to make sure that you have all the necessary documents to get your rightful tax advantages. Thus, eliminate the paper chasing and enjoy the power of a well-organized document tracking system!

Our resource directory offers valuable links to assist in managing various financial and legal aspects of a business or individual.